Essex Office:

10 Deer Park Way, Waltham Abbey, Essex, EN9 3YL

London Office:

4th Floor, Rex House, 4 – 12 Regent Street, London, SW1Y 4PE

Telephone: 0845 299 6668

Telephone: 0207 117 2523

Email: solutions@theaftersalesnetwork.com

Get in touch

Essex Office:

10 Deer Park Way, Waltham Abbey, Essex, EN9 3YL

London Office:

4th Floor, Rex House, 4 – 12 Regent Street, London, SW1Y 4PE

Telephone: 0845 299 6668

Telephone: 0207 117 2523

Email: solutions@theaftersalesnetwork.com

HMO Loans powered by The Aftersales Network

HMO Loans & Mortgages – Powered by The Aftersales Network

HMOs have been here for a while, but the model is evolving.

Co-Living and specialist or niche HMOs are becoming more main stream in today's property market.

Whilst before landlords and developers looked just to provide accommodation, now, to meet modern demand, they are creating spaces at a high standard for particular demographic groups

Our trusted network of lenders, our experience and understanding of the HMO Loan & Co-Living market makes us the first call you should make when you require a HMO or Co-Living loan solution.

Our HMO Loan specialists are available to discuss with you and guide you through each step of the process to deliver exceptional client service and assistance. We understand that turnaround times and competitive rates are your top priority and perform to ensure that every application is handled swiftly and professionally.

Our fast turnaround times means you won’t miss out on an opportunity for your business.

We are here to help… If you or your clients need funding to give their business a boost and expand, get in touch with us!

The Aftersales Network will show you a ‘Positive’ way forward.

HMO mortgages for UK Landlords

A House of Multiple Occupancy (HMO) is a specialist asset class where a single property is subdivided and individually rented out to different people who share some common areas such as bathrooms and kitchens.

HMOs are different from purpose-built flat blocks, as they usually will have been converted from larger single buildings.

The Aftersales Network work with a extensive range of specialist lenders who provide mortgages specifically for the HMO sector.

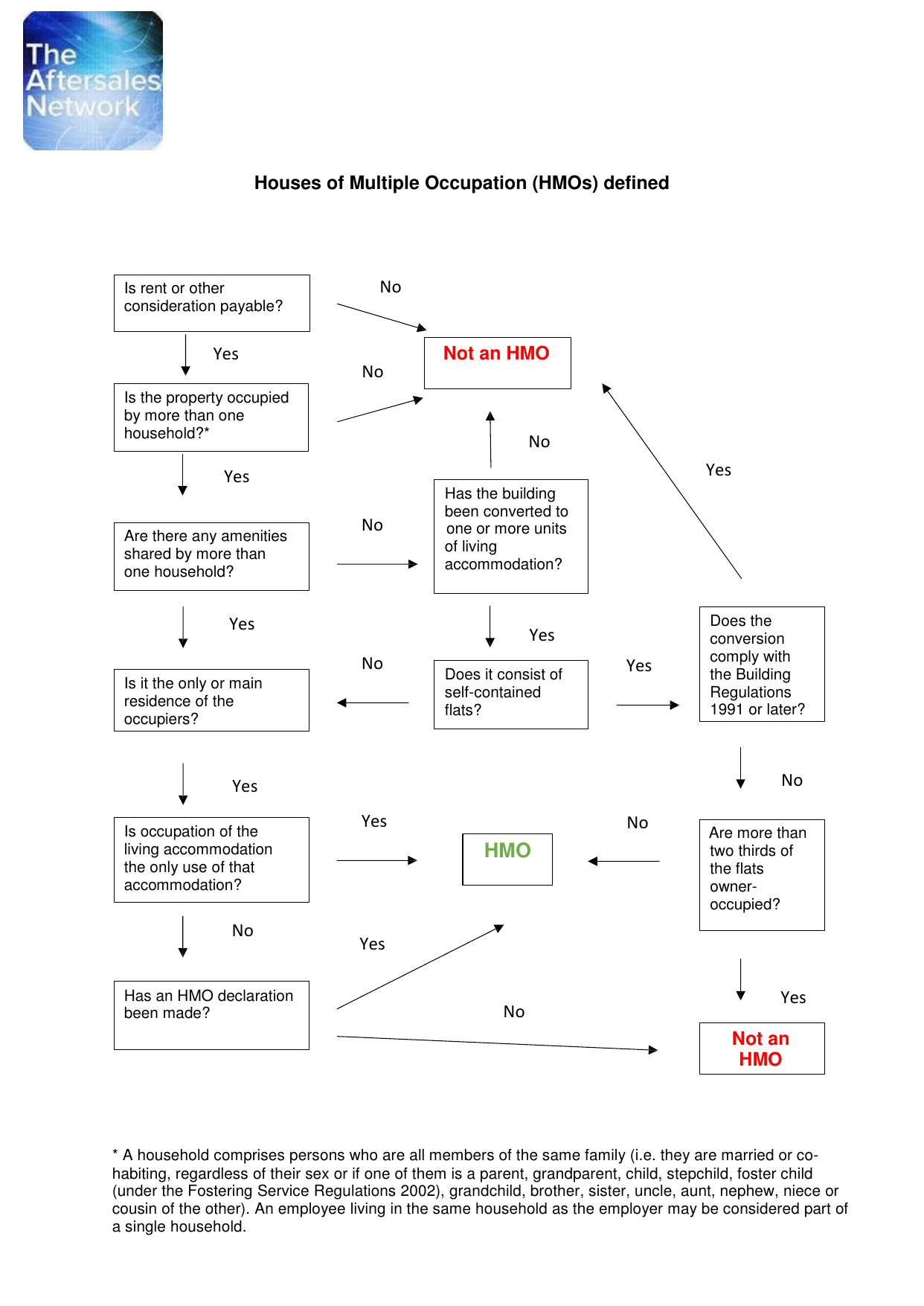

House of Multiple Occupancy (HMO) - Definition

House of Multiple Occupancy (HMO) Legislation changes October 2018

HMO NEW LICENSING LAWS Q&A

What changes are happening to the HMO licensing laws and how will they affect landlords?

From 1st October, the Government has changed the way in which Mandatory licencing applies to HMO property.

A number of properties previously not affected will fall under these new rules and these landlords will be required to apply for an HMO license in order to rent out their properties.

In addition, new minimum room sizes come into force.

What sort of properties fall under these new rules?

The government is bringing smaller HMOs within the scheme. Mandatory licensing will include:

• All HMOs with 5 or more occupiers living in 2 or more households regardless of the number of storeys. I.e. the three-storey element will be removed from the current definition.

• Purpose built flats where there are up to two flats in the block and one or both of the flats are occupied by 5 or more persons in 2 or more separate households (occupied by individuals who are not all related to one another).

This will apply regardless of whether the block is above or below commercial premises.

This will bring certain flats above shops on high streets within mandatory licensing as well as small blocks of flats which are not connected to commercial premises.

It is the individual HMO that is required to be licensed and not the building within which the HMO is situated,

So where a building has two flats and each is occupied by 5 persons living in 2 or more households, each flat will require a separate HMO licence.

New rules will also come into force setting minimum size requirements for bedrooms in HMOs to prevent overcrowding, with the license holder required;

• To notify the local housing authority of any room in the HMO with a floor area of less than 4.64m sq

• To ensure that the floor area of any room used as sleeping accommodation by one person aged over 10yrs is not less than 6.51m sq

• To ensure that the floor area of any room used as sleeping accommodation by two persons aged over 10yrs is not less than 10.22m sq

• To ensure that the floor area of any room used as sleeping accommodation by one person aged under 10yrs is not less than 4.64m sq

• To ensure that any room in the HMO with a floor area of less than 4.64m sq is not used as sleeping accommodation

However, these can still be trumped by Local Authority requirements, which do differ in many areas from the proposed National standards.

Is this a positive move by the Government?

The HMO market is growing and landlords have a duty to ensure their properties are fit to live in.

We believe the new licensing law is a positive initiative as it will improve the quality of accommodation, improve living conditions for tenants and improve the HMO sector as a whole.

Will HMO landlords have to make structural changes to their property to obtain a mandatory license?

If they are not up to date with the new legislation rules, yes, they will have to make changes.

Are HMOs still a good investment for landlords?

The HMO market is still a good investment for landlords and continues to be an increasingly important sector in the rental market.

We believe the new licensing laws will be beneficial not only for the tenant, as the quality of accommodation should be set at a higher standard, but a positive move for the HMO market and brokers who work in this sector.

We would always urge caution for those looking to enter this space as experience is important given the more complex and time-consuming nature of this asset class.

Surrounding yourself with a good team to give specialist advice is crucial in making a success within this market.

Ideally one with a good knowledge of the market, including the costs and pitfalls of running an HMO, and also who understands the Planning and Licensing regimes for the area.

The Aftersales Network has an extensive range of commercial financing options available for all people in business.

The Aftersales Network – “We’ll show you a Positive way forward”